SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No.)

| | | | | | | | |

| | |

| Filed by the Registrant | | ☒ |

| Filed by a Party other than the Registrant | | ☐ |

Check the appropriate box:

| | | | | | | | |

☒☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

NEW RELIC, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1 | | | Title of each class of securities to which transaction applies: |

| | 2 | | | Aggregate number of securities to which transaction applies: |

| | 3 | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4 | | | Proposed maximum aggregate value of transaction: |

| | 5 | | | Total fee paid: |

☐ | | Fee paid previously with preliminary materials. |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1 | | | Amount Previously Paid: |

| | 2 | | | Form, Schedule or Registration Statement No.: |

| | 3 | | | Filing Party: |

| | 4 | | | Date Filed: |

NEW RELIC, INC.

188 Spear Street, Suite 1000

San Francisco, California 94105

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On August 18, 202116, 2023

Dear Stockholder:

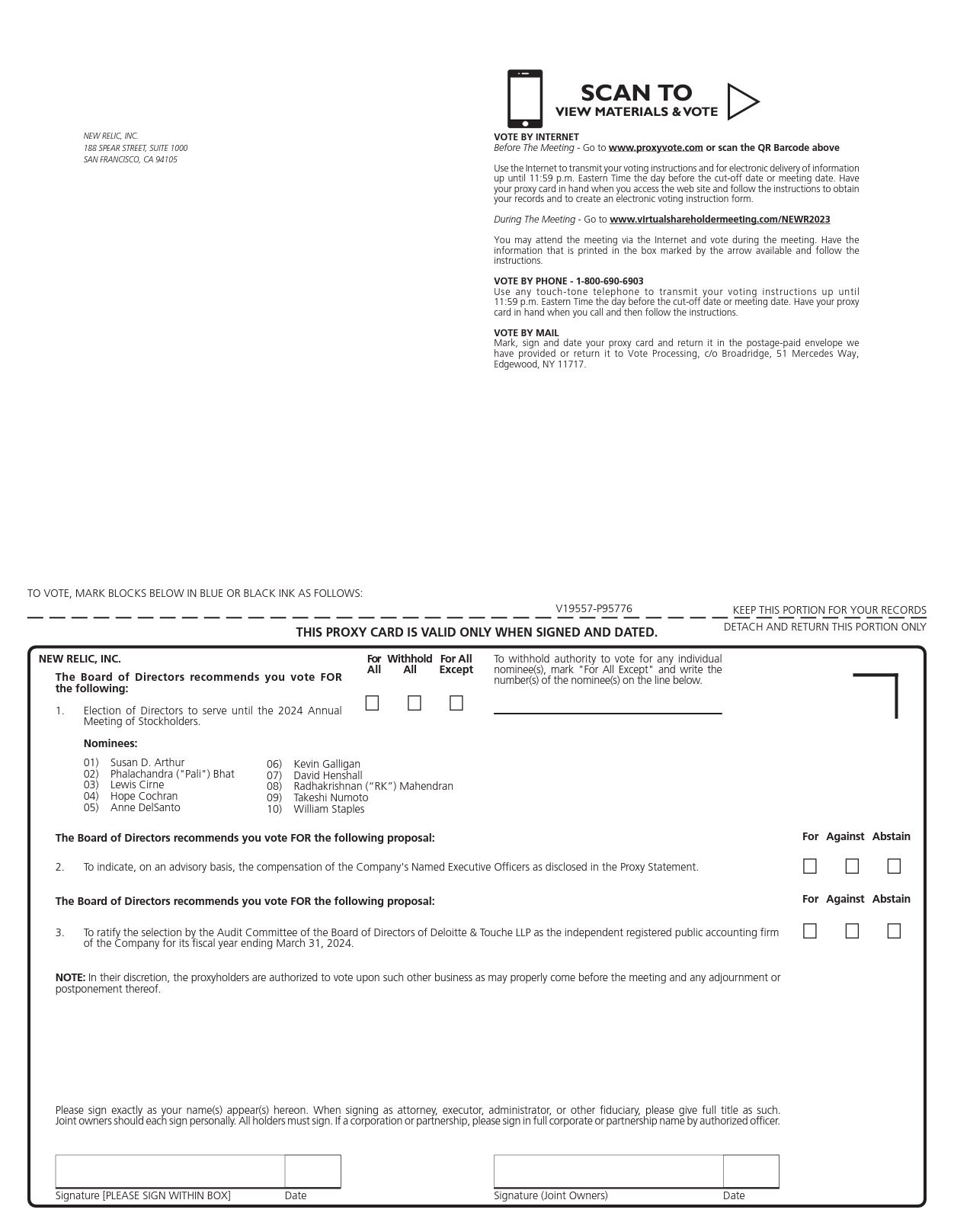

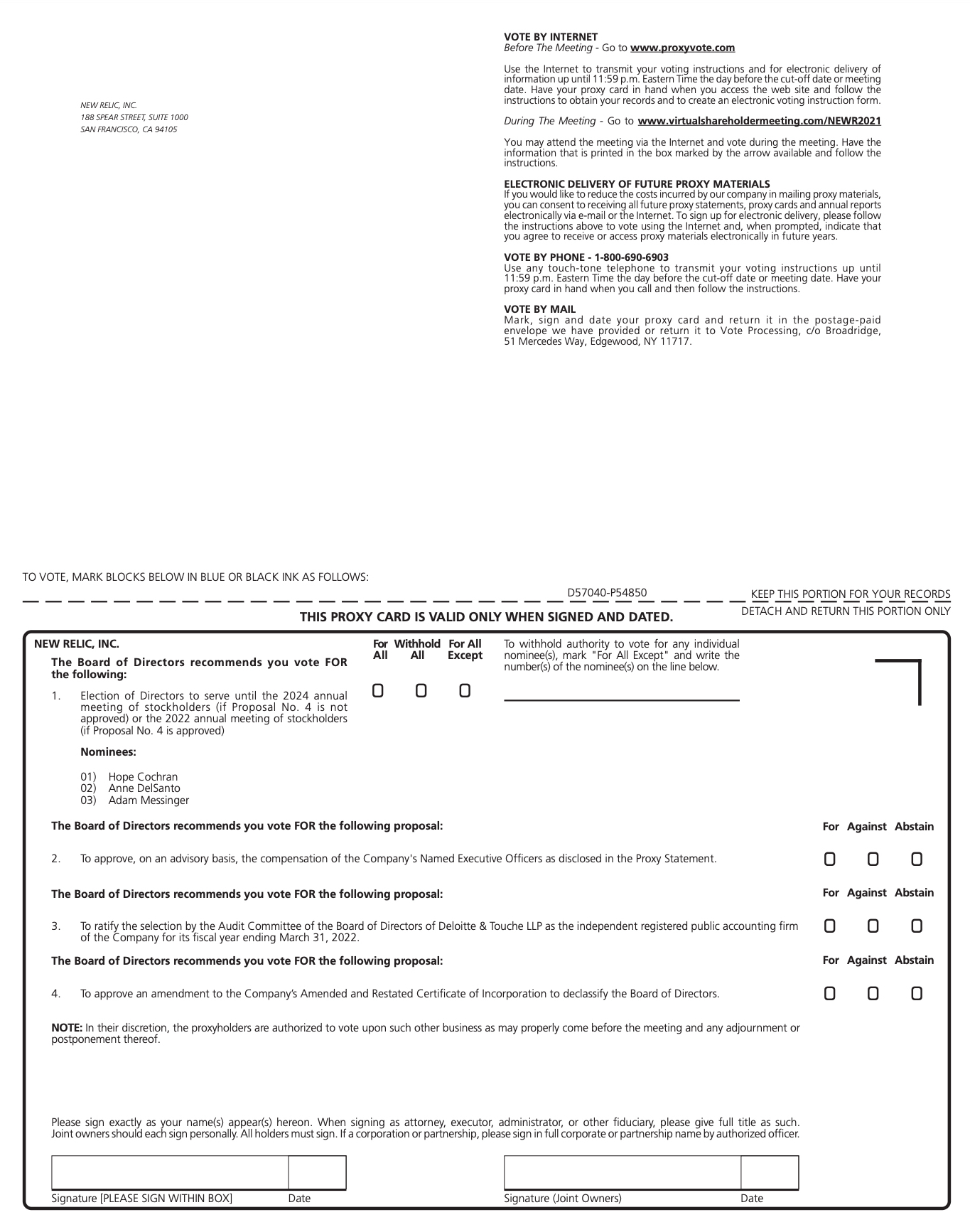

You are cordially invited to attend the Annual Meeting of Stockholders of New Relic, Inc., a Delaware corporation (the “Company”). The meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/NEWR2021NEWR2023 on Wednesday, August 18, 202116, 2023 at 9:3000 a.m. Pacific Time for the following purposes:

| | | | | |

| 1. | To elect the threeten nominees for director named in the Proxy Statement accompanying this Notice to the Board of Directors to hold office until the 2024 Annual Meeting of Stockholders (if Proposal No. 4 is not approved), or until the 2022 Annual Meeting of Stockholders (if Proposal No. 4 is approved).Stockholders. |

| | | | | |

| 2. | To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Proxy Statement accompanying this Notice. |

| | | | | |

| 3. | To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for its fiscal year ending March 31, 2022.2024. |

| | | | | |

| 4. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors. |

| | | | | |

5. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the upcoming Annual Meeting is June 22, 2021.2023. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

A complete list of such stockholders will be available for examination by any stockholder for any purpose germane to the Annual Meeting beginning ten days prior to the meeting at our headquarters at 188 Spear Street, Suite 1000, San Francisco, California 94105. If you would like to view the list, please contact us to schedule an appointment by calling (650) 777-7600. In addition, the list will be available for inspection by stockholders on the virtual meeting website during the meeting.

By Order of the Board of Directors

/s/ Thomas Lloyd

Mark SachlebenThomas Lloyd

Chief FinancialLegal Officer and Corporate Secretary

San Francisco, California

July , 2021June 30, 2023

| | |

You are cordially invited to attend the Annual Meeting, which will be held virtually via the Internet. Whether or not you expect to attend the meeting, please vote over the telephone or the Internet or, if you receive a proxy card by mail, by completing and returning the proxy card mailed to you, as promptly as possible in order to ensure your representation at the meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you receive a proxy card by mail, the instructions are printed on your proxy card and included in the accompanying Proxy Statement. Even if you have voted by proxy, you may still vote online at the virtual meeting if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the meeting, you mustmay need to obtain a proxy issued in your name from that record holder.

If you have questions about how to vote Please consult with your shares,broker, bank, or need additional assistance, please contact Innisfree M&A Incorporated, who is assisting us in the solicitation of proxies: 501 Madison Avenue, 20th Floor New York, New York 10022. Stockholders may call toll-free at (877) 750-9499. Banks and brokers may call collect at (212) 750-5833.other nominee. |

TABLE OF CONTENTS

NEW RELIC, INC.

188 Spear Street, Suite 1000

San Francisco, California 94105

PROXY STATEMENT

FOR THE 20212023 ANNUAL MEETING OF STOCKHOLDERS

August 18, 202116, 2023

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board”) of New Relic, Inc. (the “Company” or “New Relic”) is soliciting your proxy to vote at the 20212023 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the Annual Meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about July , 2021June 30, 2023 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after July , 2021.10, 2023.

How do I attend the Annual Meeting?

The meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/NEWR2021NEWR2023 on Wednesday, August 18, 202116, 2023 at 9:3000 a.m. Pacific Time. We believe that a virtual meeting provides expanded stockholder access and participation and improved communications, while affording stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting.

To attend, and submit your questions during, the virtual meeting, please visit www.virtualshareholdermeeting.com/NEWR2021.NEWR2023. To participate in the annual meeting, you will need the 16-digit control number included on your Notice. Beneficial owners who do not have a control number may gain access to the meeting by logging into their broker, brokerage firm, bank, or other nominee’s website and selecting the shareholder communications mailbox to link through to the annual meeting;Annual Meeting; instructions should also be provided on the voting instruction card provided by your broker, bank, or other nominee.

We encourage you to access the meeting prior to the start time. Please allow ample time for online check-in, which will begin at 9:158:45 a.m. Pacific Time. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page. If there are any technical issues in convening or hosting the meeting, we will promptly post information to our investor relations website, http://ir.newrelic.com, including information on when the meeting will be reconvened.

Information on how to vote at the meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on June 22, 20212023 will be entitled to vote at the meeting. On this record date, there were 64,697,060 shares70,222,436 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on June 22, 20212023 your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote online at the virtual meeting or vote by proxy over the telephone, through the Internet or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on June 22, 20212023 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. Beneficial owners may vote online at the virtual Annual Meeting with a 16-digit control number. Beneficial owners who do not have a control number may gain access to the meeting by logging into their brokerage firm’s website and selecting the stockholder communications mailbox to link through to the virtual Annual Meeting. Instructions should also be provided on the voting instruction card provided by their broker, bank, or other nominee.

What am I voting on?

There are fourthree matters scheduled for a vote:

| | | | | |

| Voting Matter | Board Vote Recommendation |

à Proposal No. 1: Election of Directors | FOR EACH NOMINEE |

| The Nominating and Corporate Governance Committee and the Board believe that each of the nominees possesses the right skills, qualifications, and experience to effectively oversee the Company’s long-term business strategy. | Page 87 |

à Proposal No. 2: Advisory Vote on the Company’s Named Executive Officer Compensation | FOR |

| The Company believes that its compensation policies and decisions are based on principles that reflect a “pay-for-performance” philosophy and are strongly aligned with our stockholders’ interests. We currently hold our Say-on-Pay vote annually. | Page 2122 |

à Proposal No. 3: Ratification of Selection of Registered Independent Accounting Firm | FOR |

The Audit Committee and the Board believe that the retention of Deloitte & Touche LLP for the fiscal year ending March 31, 20222024 is in the best interest of the Company and its stockholders. As a matter of corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of the independent registered public accounting firm. | Page 22 |

à Proposal No. 4: Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to Declassify the Board of Directors

| FOR |

The Nominating and Corporate Governance Committee and the Board believe the benefits of the Company’s classified board structure are outweighed by the advantages of a declassified board structure, which enables stockholders to evaluate the performance of all directors each year through the annual election process and, as a result, enhances the accountability of our Board to our stockholders. | Page 2423 |

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on,Proposals 2 and 3, you may vote “For” or “Against” the proposal, or “Abstain.”

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote online at the virtual Annual Meeting or vote by proxy over the telephone, through the Internet or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote online at the virtual meeting even if you have already voted by proxy.

•If you plan to attend the Annual Meeting, you may vote online by visiting www.virtualshareholdermeeting.com/NEWR2021.NEWR2023. Please have your 16-digit control number to join the Annual Meeting.

•To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on August 17, 202115, 2023 to be counted.

•To vote through the Internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your Internet vote must be received by 11:59 p.m., Eastern Time on August 17, 202115, 2023 to be counted.

•To vote using the proxy card that may be delivered to you, simply complete, sign, and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from New Relic. Simply follow the voting instructions in the Notice to ensure that your vote is counted. Beneficial owners may vote online at the virtual Annual Meeting with a 16-digit control number. Beneficial owners who do not have a control number may gain access to the meeting by logging into their brokerage firm’s website and selecting the stockholder communications mailbox to link through to the virtual Annual Meeting. Instructions should also be provided on the voting instruction card provided by their broker, bank, or other nominee.

| | |

| Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of June 22, 2021.2023.

Can I vote my shares by filling out and returning the Notice?

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by telephone or through the Internet, by requesting and returning a printed proxy card, or by submitting a ballot virtually at the Annual Meeting.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by telephone, through the Internet, by completing the proxy card that may be delivered to you or virtually at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank, or other agent how to vote your shares, your broker, bank, or other agent may still be able to vote your shares at its discretion. In this regard, under the rules of the New York Stock Exchange (“NYSE”), brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. Proposals 1 2 and 42 are considered to be “non-routine” under NYSE rules, meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 3 is considered to be a “routine” matter under NYSE rules meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 3.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of each nominee for director, “For” the advisory approval of the compensation of the Company’s named executive officers, and “For” the ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2022, and “For” the approval of an amendment to our Amended and Restated Certificate of Incorporation to declassify the Board.2024. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We have also retained Innisfree M&A Incorporated, a proxy solicitation firm, for assistance in connection with the Annual Meeting at a cost of up to $50,000, plus reasonable out-of-pocket expenses. We may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each of the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the Internet.

•You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 188 Spear Street, Suite 1000, San Francisco, California 94105. Such notice will be considered timely if it is received at the indicated address by the close of business on August 16, 2021.15, 2023.

•You may virtually attend the Annual Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by March 8, 20222, 2024 to our Corporate Secretary at 188 Spear Street, Suite 1000, San Francisco, California 94105, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); provided, however, that if our 20222024 Annual Meeting of Stockholders is held before July 19, 202217, 2024 or after September 17, 2022,15, 2024, then the deadline is a reasonable amount of time prior to the date we begin to print and mail our proxy statement for the 20222024 Annual Meeting of Stockholders.

Pursuant to our amended and restated bylaws, if you wishwith respect to bring a proposal before the stockholders or nominate a director at the 2022 Annual Meeting of Stockholders, but you are not requesting that your proposal or nominationproposals and nominations other than those to be included in next year’sour proxy materials,statement pursuant to Rule 14a-8 of the Exchange Act, including nominations subject to Rule 14a-19 of the Exchange Act, you must notify our Corporate Secretary, in writing, not later than the close of business on May 20, 202218, 2024 nor earlier than the close of business on April 20, 2022.18, 2024. However, if our 20222024 Annual Meeting of Stockholders is not held

between July 19, 202217, 2024 and September 17, 2022,15, 2024, to be timely, notice by the stockholder must be received no earlier than the close of business on the 120th day prior to the 20222024 Annual Meeting of Stockholders and not later than the close of business on the later of the 90th day prior to the 20222024 Annual Meeting of Stockholders or the 10th day following the day on which public announcement of the

date of the 20222024 Annual Meeting of Stockholders is first made. You are also advised to review our amended and restated bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

The chair of the 20222024 Annual Meeting of Stockholders may determine, if the facts warrant, that a matter has not been properly brought before the meeting and, therefore, may not be considered at the meeting. In addition, the proxy solicited by the Board for the 20222024 Annual Meeting of Stockholders will confer discretionary voting authority with respect to (i) any proposal presented by a stockholder at that meeting for which we have not been provided with timely notice and (ii) any proposal made in accordance with our amended and restated bylaws, if the 20222024 proxy statement briefly describes the matter and how management’s proxy holders intend to vote on it, and if the stockholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Exchange Act.

In connection with the 2022 Annual Meeting of Stockholders, the Company intends to file a proxy statement and a WHITE proxy card with the SEC in connection with its solicitation of proxies for that meeting.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold,” and broker non-votes; and, with respect to the other proposals,Proposals 2 and 3, votes “For,” “Against,” abstentions and, if applicable, broker non-votes.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

•For the election of directors, the threeten nominees to serve until the 2024 Annual Meeting of Stockholders (if Proposal No. 4 is not approved), or the 2022 Annual Meeting of Stockholders (if Proposal No. 4 is approved), receiving the most “For” votes from the holders of shares present by remote communication (i.e., virtually) or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” will affect the outcome. Withheld votes and broker non-votes will have no effect.

•To be approved, the advisory approval of the compensation of the Company’s named executive officers must receive “For” votes from the holders of a majority of the shares present virtually or represented by proxy and entitled to vote generally on the subject matter. If you select to “Abstain” from voting on this proposal, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

•To be approved, the ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year ending March 31, 20222024 must receive “For” votes from the holders of a majority of the shares present virtually or represented by proxy and entitled to vote generally on the subject matter. If you select to “Abstain” from voting on this proposal, it will have the same effect as an “Against” vote. Broker non-votes will have no effect; however, this proposal is considered a routine matter, and therefore no broker non-votes are expected to exist in connection with this proposal.

•To be approved, the amendment to our Amended and Restated Certificate of Incorporation must receive “For” votes from the holders of sixty-six and two-thirds percent (66⅔%) of the voting power of the outstanding shares entitled to vote generally in the election of directors. Abstentions and broker non-votes will have the same effect as votes “Against” this proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if shares representing a majority of the common stock outstanding and entitled to vote are present at the Annual Meeting virtually or represented by proxy. On the record date, there were 64,697,060 shareswere 70,222,436 shares of common stock outstanding and entitled to vote. Thus, the holdersholders of 32,348,531 35,111,219 shares must be present virtually or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank, or other nominee) or if you vote online at the virtual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of the shares present at the Annual Meeting virtually or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

COMPANY OVERVIEW

New Relic delivers theis a leading “all-in-one” observability platform for engineersthat enables our customers to plan, build, deploy, and operate more perfect software. We offer a comprehensive suitetheir critical digital infrastructure by harnessing the power of products delivered on an opendata. Our observability platform combines metrics, events, logs, traces, and extensible cloud-basedother telemetry data with our proprietary stack of analytical tools to rapidly generate actionable, fact-based insights. Our customers use our platform that enables organizations to collect, storeimprove uptime, reliability, and analyze massive amountsoperational efficiency, in order to optimize the digital experience for their customers and within their organizations.

Our goal is to enable our customers to leverage the power of data in real time so they can better operate their applications and infrastructuredata-driven analytics to monitor, debug, and improve the performance and security of all their digital customer experience.infrastructure. In order to achieve this goal:

New Relic One is our purpose-built offering•We serve all engineers. We believe today’s organizations need to make observability a continuous practice for customers to land all of their telemetry data quickly and affordablyengineers in one place, andorder to translate that data into actionable insights. We believe a truly unified front-end that sits on top of a single database helps our users avoid complexity and confusion that would be associated with relying instead upon multiple different but related products.

With our re-launch of the New Relic One platform in July 2020, we transitioned from a collection of related but disparate products, to a broader, more comprehensive observability platform. From a business perspective, we made two significant changes to our model. First, we reduced our number of SKUs from 13 unique offerings to a cohesive platform supported by three products. We believe this simplification represents tremendous value to our customers who share our vision for observability and see the value of one unified front-end on top of a single database. Second, we also changed our pricing model from upfront subscriptions to a consumption-based pricing model and adjusted our go-to-market motion to drive consumption. Customers only pay us for what they use and our sales team’s interests are better aligned with the interests of the customer.

We now believe our New Relic Oneachieve their goals. Our platform is positioned as thenot only true observability platform, which is grounded in three strategic technological pillars:

•We serve all engineers: New Relic One is used not just bygeared toward IT operations professionals, but by a wide varietyit also serves the full spectrum of engineers, including application developers, mobile developers, site reliability engineers, (“SRE”),and network engineers and more. Our mission is to democratize observability and make observability a daily practice for all engineers at every stage of the software lifecycle, and the goal of our strategic product roadmap is to deliver products that support this mission at a sustained pace.other engineers.

•We support the entire software lifecycle: New Relic One’s usage is not limited to troubleshooting applications in production environments.. Engineers can use New Relic One across production and pre-production environmentsour platform to plan, build, and test software before it goes into production.production and throughout the software lifecycle. Our ability to ship features and capabilities for the entire software lifecycle increases customer engagement with our platform’s engagementplatform and separatesdifferentiates our solutions from other tools in the marketplace that are focused solely on production troubleshooting.

•We deliver comprehensive observability asin a cohesive platform experience: We viewunified way. Unlike other products, the New Relic One as a true observability platform andis not a simple bundle of SKUsproducts with disjointed experiences and disparate pricing models stitchedclumsily aggregated into a user interface. TheOur platform has the flexibility to ingestingests significant amounts of telemetry data from any sourcea wide array of sources and modality (metrics,modalities - including metrics, events, logs, and traces)traces - and seamlessly delivers them to our users through an intuitive and unified, Artificial Intelligence (AI)-enabled interface.

We have a longstanding history of innovation within our industry. We began cloud based Application Performance Monitoring, or APM, for application developers in 2008. Since then we have expanded far beyond APM to include dozens of other product capabilities. Over the last few years we have reimagined observability by re-architecting our technology to consolidate the capabilities that have historically been served by siloed products or tools, into a unified Telemetry Data Platform. Engineers actsingle, comprehensive interoperable platform, which we call our “all-in-one” observability platform.

While most observability software is targeted toward a small subset of developers that focuses on the collected telemetry via a unified and AI-enabled user interface which converges all observability workflows into one cohesive experience.

These three strategic pillars are reinforced by our consumption-based pricing model. We believe observability should be a critical daily practice for all engineers and that true observability means customers are without blind spots. We found pre-existing pricing models to have the unintended effect of limiting instrumentation and, ultimately, customer visibility into their system performance. With our shift to a consumption-based pricing model and simplified platform offering,“operate” phase, we believe we have removed those barriers.that telemetry data is also critical to the rest of the software lifecycle including the planning, building, and deployment phases. We collapsed what had previously been a numbertarget the broader software developer productivity market, helping them realize the value of different products priced in individualized ways. Now, to accelerate engagement, adoption, and consumption of our platform, we price based on consumption as measured by the number of users and the amount oftelemetry data ingested into our system. By removing data silos and standardizing on a singlethat is wasted if unharnessed. Our all-in-one observability platform customers across the globe can more easilyhelps remove data, tool, and team silos that plague organizations, empowering them to better understand end-to-end system health and are better abletheir entire digital infrastructures in order to achieve business imperatives ofimprove their speed of innovation, operational excellence, system reliability, and cost management. We primarily utilize a consumption-based model that directly links the value our customers receive from utilizing our platform with what they pay for it, in a manner that is transparent and intuitive for them.

We have been named a leader in the Gartner APM and Observability Magic Quadrant for each of the last ten years. During the fiscal year 2023, Gartner ranked us among the top 3 vendors (of 19) based on completeness of vision and ability to execute, and in fiscal year 2022 we won the Customers’ Choice in the Gartner Peer Insights ‘Voice of the Customer’ for Application Performance Monitoring. In March 2023, we were also recognized as the innovation leader in GigaOm’s Radar for Cloud Observability report of the 21 vendors they evaluated.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board is currently divided into three classes. Each class consists, as nearly as possible,classes, but our Board will be fully declassified following the Annual Meeting. We have undergone a phased declassification in accordance with an amendment to our amended and restated certificate of one-thirdincorporation approved by our Board and stockholders in fiscal year 2022 (the “Declassification Amendment”). Under the terms of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by the affirmative vote of a majority of the directors then in office, even though less than a quorum of the Board. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, will serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

On May 8, 2021, Mr. Cirne and our Board determined that Mr. Cirne would transition from his role as Chief Executive Officer to Executive Chairman of the Board, effective July 1, 2021. In connection with Mr. Cirne’s appointment as Executive Chairman, our Board appointed Hope Cochran, who has served as Chair of the Board since August 2020, to serve as Vice Chair of the Board and Lead Independent Director, effective July 1, 2021.

In connection with this transition, our Board promoted Mr. Staples to Chief Executive Officer and appointed Mr. Staples as a Class II director, whose term expiresDeclassification Amendment, beginning at the annual meeting2021 Annual Meeting of stockholdersStockholders, directors stood for election to be held in 2022, each effective July 1, 2021.

On June 24, 2021,one-year terms after the Board increased the sizeexpiration of the Board to ten directors and appointed Radhakrishnan (“RK”) Mahendran, Partner at HMI Capital, the largest institutional shareholder in New Relic, to the Board as a Class III director whose term expires at the annual meeting of stockholders to be held in 2023. Also on June 24, 2021, one of our Class III directors, Michael Christenson, agreed to resign from all positionstheir respective current terms, with the Company, including as a member ofresult that the entire Board effective June 30, 2021. Mr. Christenson’s decision was not a result of any disagreement with us or our operations, policies, or practices.

With these changes, the Board presently has ten members. There are three directors in the class whose term of office expires in 2021, and three nominees for electionwill be elected on an annual basis at the Annual Meeting.Meeting and at each annual meeting thereafter. If elected at the Annual Meeting, each of theseour director nominees would serve until the 2024 Annual Meeting of Stockholders (if Proposal No. 4 is not approved), or until the 2022 Annual Meeting of Stockholders (if Proposal No. 4 is approved) and until his or her successor has been duly elected and qualified, or, if sooner, until his or her death, resignation, or removal.

On June 4, 2022, we entered into a cooperation agreement (the “Cooperation Agreement) with JANA Partners LLC (“JANA”). Pursuant to the Cooperation Agreement, each of Adam Messinger, Dan Scholnick and James Tolonen resigned from the Board and all applicable committees thereof, effective June 13, 2022. Contingent upon the execution of the Cooperation Agreement, the Board appointed each of Susan D. Arthur and Kevin Galligan to the Board as a Class II director of the Company with a term expiring at the 2022 Annual Meeting, effective immediately following the resignations of Messrs. Messinger, Scholnick and Tolonen. In addition, the Board appointed Phalachandra (“Pali”) Bhat to the Board, as a Class II director of the Company with a term expiring at the 2022 Annual Meeting, to fill the remaining vacancy on the Board following the director resignations described above and effective immediately following such resignations. Each of Susan D. Arthur, Kevin Galligan and Pali Bhat was elected by our stockholders at the 2022 Annual Meeting. On April 17, 2023, we entered into a letter agreement (the “Letter Agreement”) with JANA. Pursuant to the Letter Agreement, we agreed to nominate Kevin Galligan for election to our Board at the Annual Meeting, subject to certain conditions.

Director Nominees

Our Board currently consists of eleven directors. There are ten nominees for director this year, and Other Directors

Caroline Watteeuw Carlisle’s term will expire at the Annual Meeting. Upon the expiration of Ms. Watteeuw Carlisle’s term, the authorized number of directors constituting the Board will be ten. Ensuring the Board is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, experience, and backgrounds, and effectively represent the long-term interests of stockholders is a top priority of the Board and Nominating and Corporate Governance Committee.

The Board believes periodic assessment of directors is integralthat maintaining a diverse membership with varying backgrounds, skills, expertise and other personal characteristics promotes inclusiveness, enhances the Board’s deliberations and enables the Board to an effective governance structure and aims to strike a balance between ensuring that we retain directors with deep knowledgebetter represent all of the CompanyCompany’s constituents, including its diverse customer base and workforce. Accordingly, while adding directors who bringwe do not have a fresh perspective. separate written Board diversity policy, the Board is committed to regular renewal and refreshment and seeking out highly qualified candidates with diverse backgrounds, skills and experiences as part of each Board candidate search undertaken, including actively seeking women and minority director candidates for consideration.

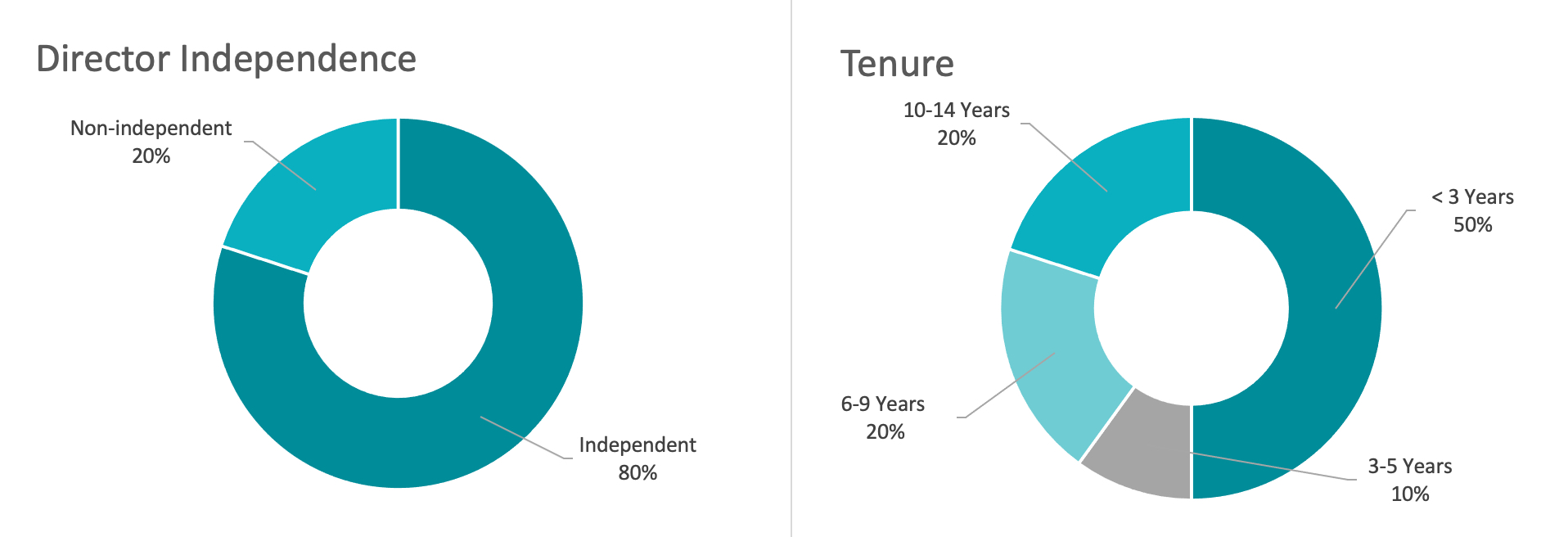

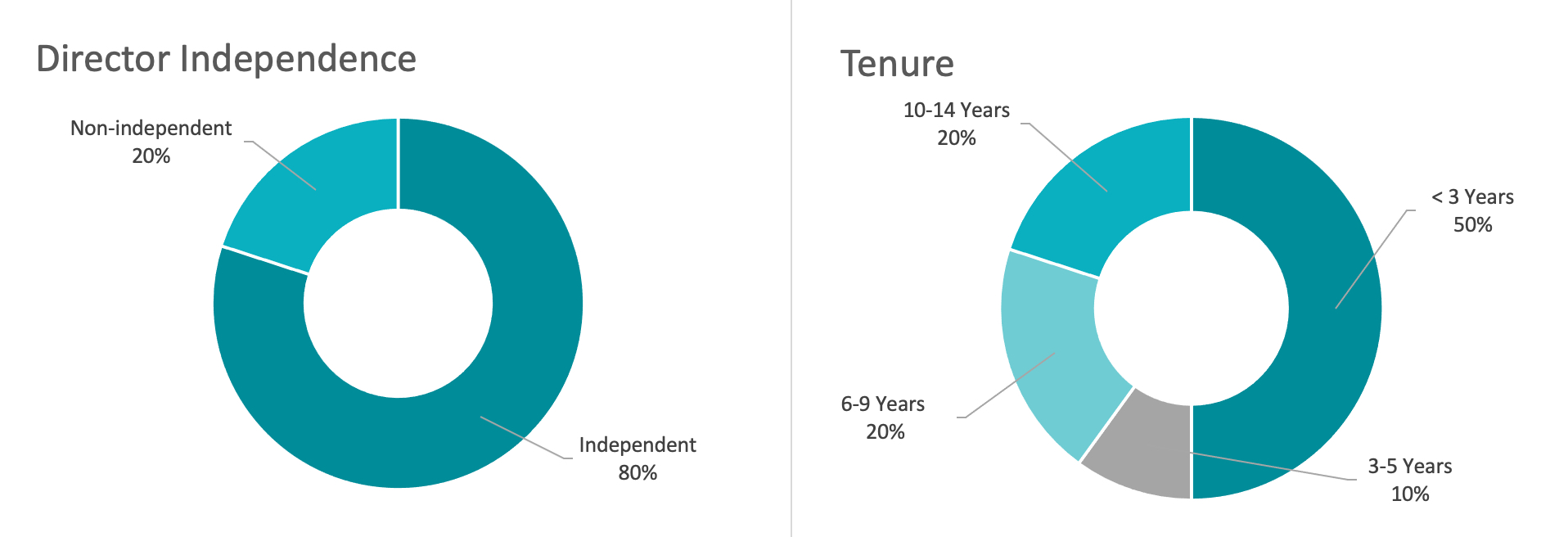

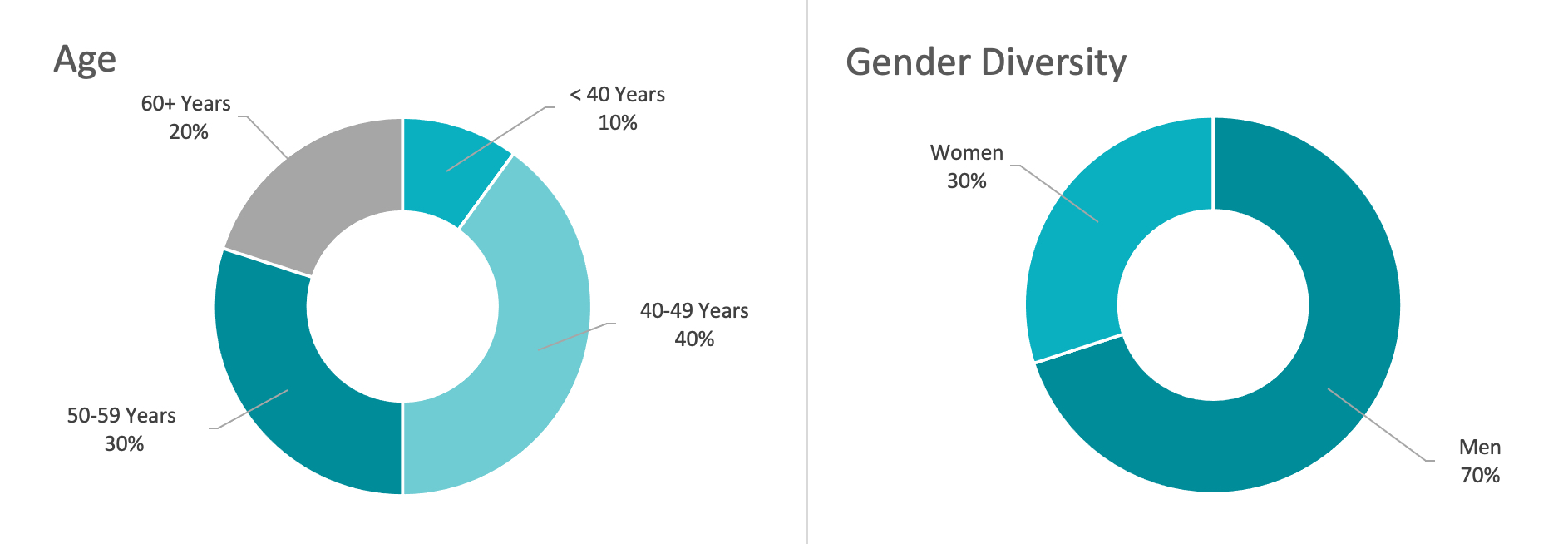

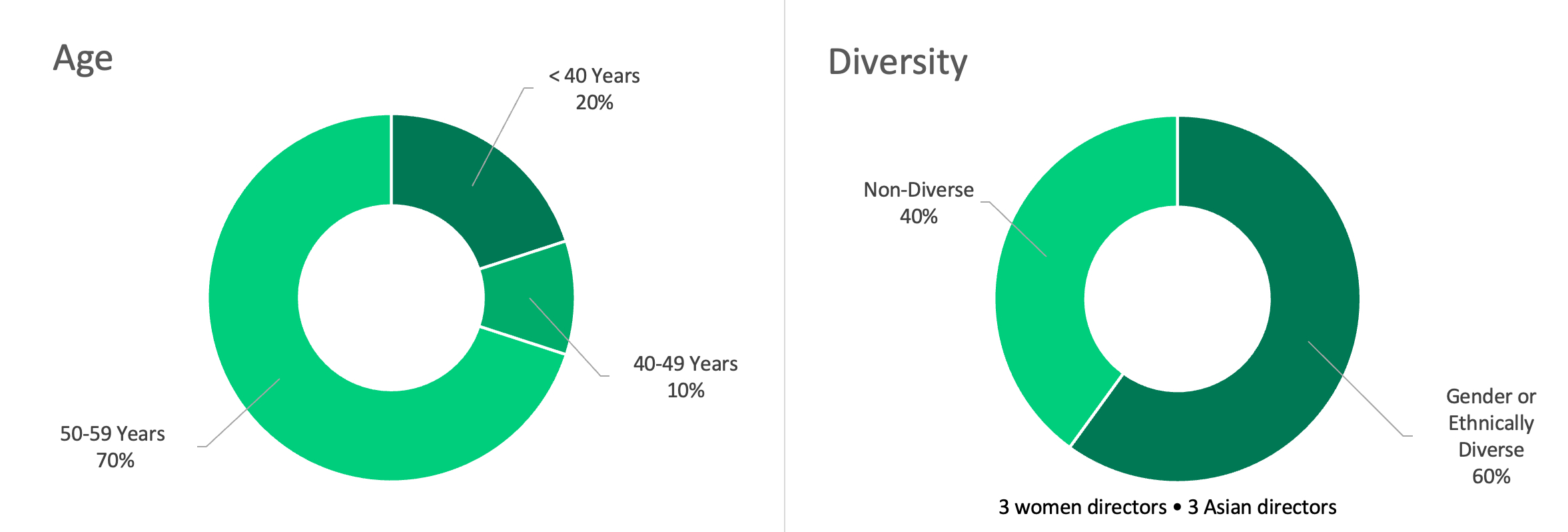

We have added fourthree new directors since the beginning of fiscal 20212023, enhancing the Board’s breadth and depth of experience and diversity, while taking into account the Company’s evolving business model, the macro technology business environment, and the changing governance landscape. Below is a breakdown of the composition of our nominees for director by independence, tenure, age, and diversity.

The following table sets forth information with respect to our directors, including the three nominees for election at the Annual Meeting, all of whom are current directors, as of July 1, 2021:May 31, 2023:

| | | | | | | | | | | | | | | | | | | | |

Name | | Age |

| Name | | Director SinceAge | | Director Since | | Principal Occupation / Position Held with the Company | Diversity |

| | | | | | |

Class I Directors — Nominees for Election at the Annual Meeting |

Hope CochranSusan D. Arthur | | 4957 | | May 2018June 2022 | | President of Optum Global Advantage and Director of New Relic | * |

| Pali Bhat | | 49 | | June 2022 | | Chief Product Officer at Reddit Inc. and Director of New Relic | † |

| Lewis Cirne | | 53 | | Feb. 2008 | | Founder and Executive Chairman of New Relic | |

| Hope Cochran | | 51 | | May 2018 | | Managing Director at Madrona Venture Group and Vice Chair and Lead Independent Director of New Relic | * |

| Anne DelSanto | | 5859 | | Aug. 2020 | | Director of New Relic | * |

Adam MessingerKevin Galligan | | 4939 | | Apr. 2014June 2022 | | Partner and Director of New Relic |

| | | | | | |

Class II Directors — Continuing in Office until the 2022 Annual Meeting of Stockholders |

Caroline Watteeuw Carlisle | | 69 | | Aug. 2018 | | Senior Technology AdvisorResearch at Innovation Through TechnologyJANA Strategic Investments and Director of New Relic | |

Dan ScholnickDavid Henshall | | 4355 | | Oct. 2008Aug. 2020 | | General Partner at Four Rivers Group and Director of New Relic |

William Staples | | 48 | | July 2021 | | Chief Executive Officer and Director of New Relic |

James Tolonen | | 72 | | May 2016 | | Director of New Relic |

| | | | | | |

Class III Directors — Continuing in Office until the 2023 Annual Meeting of Stockholders |

Lewis CirneRK Mahendran | | 5134 | | Feb. 2008June 2021 | | Founder and Executive Chair of New Relic |

David Henshall | | 53 | | Aug. 2020 | | Chief Executive Officer and Director of Citrix and Director of New Relic |

RK Mahendran | | 33 | | June 2021 | | Partner at HMI Capital Management, L.P. and Director of New Relic | † |

| Takeshi Numoto | | 52 | | Dec. 2021 | | EVP and Chief Marketing Officer at Microsoft and Director of New Relic | † |

| William Staples | | 50 | | July 2021 | | Chief Executive Officer and Director of New Relic | |

* Director has self-identified as female.

† Director has self-identified as ethnically diverse (Asian).

Each of the nominees for election at the Annual Meeting was recommended for election by the Nominating and Corporate Governance Committee. All three of the nominees are current directors and, if elected, will be continuing their roles on the Board. Ms. CochranEach of our director nominees, except for Messrs. Henshall and Mr. MessingerNumoto, have previously been elected by our stockholders. Messrs. Henshall and Numoto are up for re-election this year and Ms. DelSanto is up for election for the first time since being appointed to the Board in August 2020.2020 and December 2021, respectively. Regarding Ms. DelSanto’s appointment, a third-party search firm provided theMessrs. Henshall and Numoto’s appointments, our management and members of our Board and management withreceived information regarding several potential candidates, including Ms. DelSanto.Messrs. Henshall and Numoto, in connection with our regular search to add qualified members to our Board. After performing further evaluation of Ms. DelSanto’sMessrs. Henshall and Numoto’s particular experience, qualifications, attributes, and skills, the Nominating and Corporate Governance Committee recommended her appointmenttheir respective appointments to the Board.

Directors are elected by a plurality of the votes of the holders of shares present virtually or represented by proxy and entitled to vote generally on the election of directors. Accordingly, the threeten nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the threeten nominees named in this Proxy Statement. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by the Board. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.

The following is a brief biography of each nominee, and each director whose term will continue after the Annual Meeting. The biographies belowwhich also includeincludes information regarding the specific experience, qualifications, attributes, or skills of each

nominee or director that led the Nominating and Corporate Governance Committee to determine that such individual should serve as a member of the Board.

NOMINEESFOR ELECTIONTO SERVE UNTILTHE 2024 ANNUAL MEETING (IF PROPOSAL NO. 4 IS NOT APPROVED) OR TO SERVE UNTIL THE 2022ANNUAL MEETING (IF PROPOSAL NO. 4 IS APPROVED)Susan D. Arthur has served as a member of our Board since June 2022. In addition, she has served as President of Optum Global Advantage since May 2023. Previously, Ms. Arthur served as Chief Executive Officer of CareerBuilder, LLC from July 2021 to May 2023. From September 2019 to July 2021, Ms. Arthur served as Chief Operating Officer at OptumInsight, the healthcare technology services division of United Health Group Incorporated. Prior to joining Optum, Ms. Arthur served in a number of leadership roles at technology service companies, including as Group President at NTT Data from March 2018 to September 2019, Vice President and General Manager at DXC Technology from April 2017 to March 2018, Vice President and General Manager—Regulated Industries at Hewlett Packard Enterprise from November 2015 to March 2017, and a number of Vice President and General Manager positions at HP from 2008 until October 2015. Ms. Arthur has also served on the board of directors of Rackspace Technology, Inc. since April 2020. Ms. Arthur received a B.A. from Gettysburg College in Economics and Spanish. We believe Ms. Arthur is qualified to serve as a member of our Board based on her extensive leadership experience in the technology services sectors.

Pali Bhat has served as a member of our Board since June 2022. In addition, he has served as the Chief Product Officer of Reddit Inc., an online community of communities company, since October 2021. Prior to Reddit, Mr. Bhat worked for Google, Inc. from March 2011 to October 2021, where he most recently served as Vice President of Product Management from May 2017 to October 2021. Earlier in his career, Bhat was Vice President at SAP Labs and a consultant with McKinsey & Co. Mr. Bhat holds a M.S. in Computer Science from the University of Illinois Urbana-Champaign and an M.B.A. from Duke University. We believe Mr. Bhat is qualified to serve as a member of our Board based on his extensive leadership experience in the technology services sectors.

Lewis Cirne founded our Company and has served as our Executive Chairman since July 2021 and as a member of our Board since February 2008. He previously served as our Chief Executive Officer from February 2008 through June 2021. From 1998 to 2001, Mr. Cirne was founder and Chief Executive Officer, and from 2001 to 2006, he was Chief Technology Officer, of Wily Technology, Inc. Prior to Wily Technology, Inc., Mr. Cirne held engineering positions at Apple Inc. and Hummingbird Ltd. Mr. Cirne holds an A.B. in Computer Science from Dartmouth College. We believe that Mr. Cirne is qualified to serve as a member of our Board because of his operational and historical expertise gained from serving as our Chief Executive Officer. As our founder and the longest serving member of our Board, we also value his deep understanding of our business as it has evolved over time.

Hope Cochran has served as a member of our Board since May 2018. Ms. Cochran is currently a Managing Director at Madrona Venture Group, where she has served in this position since 2019 and as a venture partner since January 2017. From September 2013 to June 2016, Ms. Cochran served as the Chief Financial Officer of the gaming company King Digital Entertainment plc, which was acquired by Activision Blizzard, Inc. in February 2016. Prior to King Digital, she served as the Chief Financial Officer of Clearwire Corporation, a telecommunications operator, from February 2011 until its acquisition by Sprint, Inc. in July 2013. Previously, she has held several roles in the software industry, including at PeopleSoft, Inc., Evant Inc., and SkillsVillage Inc., a human resources software company that she founded. Ms. Cochran currently serves on the board of directors of Hasbro, Inc. and MongoDB, Inc. Ms. Cochran received a B.A. in Economics and Music from Stanford

University. We believe Ms. Cochran is qualified to serve as a member of our Board based on her financial and operating background and her experience serving on the boardboards of directors of public companies.

Anne DelSanto has served as a member of our Board since August 2020. In addition, she has served as a limited partner at Operator Collective, a venture fund, since December 2019. Ms. DelSanto has also served as a limited partner at Stage 2 Capital, a venture fund, since March 2019. From February 2018 to April 2019, she served as Executive Vice President and General Manager, Platform at Salesforce.com, Inc. (“Salesforce”), a customer relationship management company. Prior to that role, she served in various executive-level roles at Salesforce since October 2012, including Executive Vice President, Americas Solution Engineering & Cloud Sales from February 2016 to February 2018. Prior to joining Salesforce, Ms. DelSanto served in various roles of increasing responsibility in pre-sales from 1999 to 2012 at Oracle Corporation, an information technology and services company, including most recently as Group Vice President, Sales Engineering from February 2012 to September 2012. Ms. DelSanto currently serves on the board of directors of Juniper Networks, Inc., a networking and cybersecurity solutions company, and Advanced Energy, Inc., a global power supply manufacturer. Ms. DelSanto holds a B.S. in Mathematics, with a concentration in Computer Science from St. John’s University and a M.S. in Administrative Studies from Boston College. We believe Ms. DelSanto is qualified to serve as a member of our Board because of her extensive experience as a senior sales executive at several technology companies, and her broad industry expertise with cloud-businesses and software-as-a-service business models.

Adam Messinger

Kevin G. Galligan has served as a member of our Board since April 2014. Since November 2018,June 2022. In addition, he serves as the Director of Research at JANA Strategic Investments, a strategic investment fund specializing in enhancing shareholder value through active engagement, since January 2022, and a Partner of JANA Partners LLC since December 2017, where he previously was a Managing Director and held various other titles since February 2011. Prior to that, Mr. Messinger Galligan was with Kohlberg Kravis Roberts & Company, an alternative investment management company, where he worked in their North America Private Equity group from July 2007 to January 2011. Before that, he worked in the Mergers & Acquisitions Advisory Division of the Blackstone Group, an alternative investment management company, from July 2005 to June 2007. Mr. Galligan received a B.A. in Economics from Columbia University. We believe Mr. Galligan is qualified to serve as a member of our Board because of his experience as an investor and his experience in the financial services and capital markets sectors.

David Henshall has served as a technical advisor to various technology companies. From March 2013 until December 2016,member of the Board since August 2020. Mr. MessingerHenshall previously served as the President and Chief TechnologyExecutive Officer of Twitter,Citrix Systems, Inc. (“Citrix”), an online social mediaa multinational software and cloud computing company, wherefrom July 2017 to October 2021. Prior to that role, Mr. Henshall held a number of senior executive roles within Citrix, including Chief Operating Officer, Chief Financial Officer and Acting President and Chief Executive Officer between 2003 and 2017. Prior to joining Citrix, Mr. Henshall served as Chief Financial Officer of Rational Software Corporation, a software company acquired by IBM Corporation in 2003, and also held various finance positions at Cypress Semiconductor Corporation and Samsung Semiconductor, Inc. Mr. Henshall has served on the board of directors of Everbridge, Inc. since January 2022 and was appointed Chairman of Everbridge’s board in January 2023; he previously served as Vice Presidenton Everbridge’s board from July 2015 to May 2018. Mr. Henshall has also served on the board of Application Developmentdirectors of HashiCorp, Inc. since September 2022 and additionally serves on the board of directors of Feedzai. Mr. Henshall previously served on the board of directors of Citrix from April 2012July 2017 to March 2013,October 2021 and Vice President of Platform DevelopmentLogMeIn, Inc. from November 2011February 2017 to April 2012. Prior to that,August 2020. Mr. Messinger was Vice President of Development at Oracle Corporation, a computer technology company, from January 2008 to November 2011. Mr. MessingerHenshall holds a B.S. in Physics and Computer Science from Willamettethe University of Arizona and an M.S. in ManagementM.B.A. from StanfordSanta Clara University. We believe Mr. MessingerHenshall is qualified to serve as a member of our Board because of his extensive experience as a senior executive in the software developmenttechnology industry both as a developer of tools for other developers and of large online services andwell as an executive at a variety of software development organizations.his financial expertise.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2022 ANNUAL MEETING

Caroline Watteeuw CarlisleRadhakrishnan (“RK”) Mahendran has served as a member of ourthe Board since August 2018. Through Innovation Through Technology, she currently serves asJune 2021. Mr. Mahendran is a Partner, Member of the Chief Technology Officer of CortenInvestment Committee, and Software Sector Head at HMI Capital and acts as a senior technology advisor to chief executive officers and corporate boards. She served as Executive Vice President and Chief Information Officer of Caliber Home Loans, Inc. from June 2016 until February 2019. Previously, she served as a Technology Officer at Warburg Pincus LLC supporting their technology due diligence process and advising their portfolio companies.Management, L.P., an investment firm based in San Francisco, since September 2014. Prior to that, Ms. Watteeuw Carlisle served in various rolesHMI Capital, Mr. Mahendran worked at PepsiCo, Inc., including Chief Information Officer for North America,Thomas H. Lee Partners, a Boston-based private equity firm, from July 2012 to July 2014 and Global Chief Technology Officer and Senior Vice President Business Information Solutions. Before PepsiCo, Inc., she held several technology roles, including at iFormation Group, TradingEdge, and Credit Suisse Group AG. Ms. Watteeuw Carlisle served on the board of directors of Capgemini SE and has beenGoldman Sachs, an investment banking firm, from July 2010 to June 2012. Mr. Mahendran holds a Trustee of New York Institute of Technology since November 2015. Ms. Watteeuw Carlisle received an Engineering degree at the University of Ghent in Belgium and a M.S. in Chemical and Biochemical EngineeringBBA from the University of Pennsylvania.Texas at Austin. We believe Ms. Watteeuw Carlislethat Mr. Mahendran is qualified to serve as a member of our Board because of her extensive background in the software industry, including her experience in several senior technology leadership roles.due to his financial and governance experience.

Dan ScholnickTakeshi Numoto has served as a member of ourthe Board since October 2008. Mr. Scholnick is currently a General Partner at Four Rivers Group, a venture capital firm. Previously,December 2021. In addition, he served in various roles at Trinity Ventures, a venture capital firm, from September 2007 to June 2019, andhas served as General Partner from 2010 until June 2019.Executive Vice President and Commercial Chief Marketing Officer of Microsoft Corporation (“Microsoft”), a multinational technology company, since March 2020. Prior to that he worked at SVB Capital,role, Mr. Numoto held a number of roles within Microsoft, including Corporate Vice President, Cloud Marketing from January 2012 to March 2020 and Corporate Vice President, Office Marketing from January 2009 to January 2012. Mr. Numoto holds a B.A. in Law from the venture capital investment armUniversity of SVB Financial Group, from 2004 to 2005, and founded Flurry, Inc., a mobile analytics software company, in 2005. Mr. Scholnick holds an A.B. in Computer Science from Dartmouth CollegeTokyo and an M.B.A. from Harvard Business School.Stanford University. We believe Mr. ScholnickNumoto is qualified to serve as a member of ourits Board because of his extensive experience as a senior executive in the venture capital industry and his knowledge of technology companies.industry.

William Staples has served as our Chief Executive Officer since July 2021, Chief Product Officer of the Company from February 2020 to January 2021, and as President and Chief Product Officer of the Company from January 2021 through June

2021. From September 2017 to January 2020, Mr. Staples served as the Vice President of Experience Cloud Engineering at Adobe, Inc., where he led the global engineering team behind Adobe Inc.’s market-leading Experience Cloud. From 1999 to March 2016, Mr. Staples served in various product, design, and engineering roles at Microsoft, Inc., most recently as Vice President of Azure Application Platform. He holds a B.S. from the University of Utah. We believe that Mr. Staples is qualified to serve as a member of our Board because of his extensive experience as a product executive in the technology industry and his deep understanding of our business strategies, objectives, and products.

James Tolonen has served as a member of our Board since May 2016. Mr. Tolonen served as the Senior Group Vice President and Chief Financial Officer of Business Objects, S.A., an enterprise software solutions provider, where he was responsible for its finance and administration commencing in January 2003 until its acquisition by SAP AG in January 2008. He remained with SAP AG until September 2008. Mr. Tolonen served as the Chief Financial Officer and Chief Operating Officer and a member of the board of directors of IGN Entertainment Inc., an Internet media and service provider, from October 1999 to December 2002. He served as President and Chief Financial Officer of Cybermedia, a PC user security and performance software provider, from April 1998 to September 1998, where he also served as a member of the board of directors from August 1996 to September 1998. Mr. Tolonen served as Chief Financial Officer of Novell, Inc., an enterprise software provider, from June 1989 to April 1998. Mr. Tolonen previously served on the boards of directors of MobileIron, Inc., Imperva, Inc., Blue Coat Systems, Inc., and Taleo Corporation. Mr. Tolonen holds a B.S. in Mechanical Engineering and an M.B.A. from University of Michigan. Mr. Tolonen is also a Certified Public Accountant, inactive, in the State of California. We believe Mr. Tolonen is qualified to serve as a member of our Board because of his background in accounting, his extensive experience as chief financial officer for a number of publicly-held companies, including at several software companies, as well as his involvement on numerous audit committees.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2023 ANNUAL MEETING

Lewis Cirne founded our Company and has served as our Executive Chairman since July 2021 and as a member of our Board since February 2008. He previously served as our Chief Executive Officer from February 2008 through June 2021. From 1998 to 2001, Mr. Cirne was founder and Chief Executive Officer, and from 2001 to 2006, he was Chief Technology Officer, of Wily Technology, Inc. Prior to Wily Technology, Inc., Mr. Cirne held engineering positions at Apple Inc. and Hummingbird Ltd. Mr. Cirne holds an A.B. in Computer Science from Dartmouth College. We believe that Mr. Cirne is qualified to serve as a member of our Board because of his operational and historical expertise gained from serving as our Chief Executive Officer. As our founder and the longest serving member of our Board, we also value his deep understanding of our business as it has evolved over time.THE BOARD OF DIRECTORS RECOMMENDS

David Henshall has served as a member of the Board since August 2020. In addition, he has served as the President and Chief Executive Officer of Citrix Systems, Inc. (“Citrix”), a multinational software and cloud computing company, since July 2017. Prior to that role, Mr. Henshall held a number of senior executive roles within Citrix, including Chief Financial Officer and Chief Operating Officer from February 2014 to July 2017. Prior to joining Citrix, Mr. Henshall served as Chief Financial Officer of Rational Software Corporation, a software company acquired by IBM Corporation in 2003, and also held various finance positions at Cypress Semiconductor Corporation and Samsung Semiconductor, Inc. Mr. Henshall currently serves on the board of directors of Citrix. Mr. Henshall previously served on the board of directors of Everbridge, Inc. from July 2015 to May 2018 and LogMeIn, Inc. from February 2017 to August 2020. Mr. Henshall holds a B.S. in Business Administration from the University of Arizona and an M.B.A. from Santa Clara University. We believe Mr. Henshall is qualified to serve as a member of our Board because of his extensive experience as a senior executive in the technology industry as well as his financial expertise.

Radhakrishnan (“RK”) Mahendran has been a Partner, Member of the Investment Committee, and Software Sector Head at HMI Capital Management, L.P., an investment firm based in San Francisco, since September 2014. Prior to HMI Capital, Mr. Mahendran worked at Thomas H. Lee Partners, a Boston-based private equity firm, from July 2012 to July 2014 and Goldman Sachs, an investment banking firm, from July 2010 to June 2012. Mr. Mahendran holds a BBA from the University of Texas at Austin. We believe that Mr. Mahendran is qualified to serve as a member of our Board due to his financial and governance experience.AVOTE IN FAVOR OF EACH NAMED NOMINEE.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Director Independence

Our Board has undertaken a review of its composition, the composition of its committees, and the independence of each director. Our Board has determined that, other than Mr. Cirne and Mr. Staples, none of our current directors has a relationship that would bear on the materiality of his or her relationship to us and that each is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. Accordingly, a majority of our directors are independent, as required under applicable NYSE rules. Further, the Board previously determined that Peter Fenton,each of Messrs. Messinger, Scholnick and Tolonen, who served on the Board until August 19, 2020,June 13, 2022, did not have a relationship that would bear on the materiality of his relationship to us and that hesuch director was “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. In making this determination, our Board considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, relevant transactions between our Company and entities associated with our directors or members of their immediate families, including transactions in the ordinary course of business, and other transactions, relationships, and arrangements that are not required to be disclosed in this Proxy Statement.

Board Leadership Structure

The Board’s leadership structure currently consists of an Executive Chairman of the Board and a Vice Chair and Lead Independent Director who is appointed, and at least annually reaffirmed, by at least a majority of our independent directors. Mr. Cirne has served as Executive Chairman of the Board since July 1, 2021 and served as Chief Executive Officer of the Company from 2008 through June 2021. Ms. Cochran served as Chair of the Board from August 2020 through June 2021 and has served as the Vice Chair and Lead Independent Director since July 2021. On June 11, 2023, Mr. Cirne agreed with the Company that he will transition from his current role as Executive Chairman to the role of Chairman of the Board (non-executive), effective upon the conclusion of the Annual Meeting, contingent on his re-election to serve as a director at the Annual Meeting. Mr. Cirne’s duties as Chairman will remain unchanged. In connection with this transition and the revisions to committee membership discussed below, in June 2023, the Board determined that, effective upon the conclusion of the Annual Meeting, Mr. Henshall will serve as the Board’s Vice Chair and Lead Independent Director, contingent on his re-election to serve as a director at the Annual Meeting.

The duties of the Executive Chairman, Vice Chair and Lead Independent Director, and Chief Executive Officer are set forth in the table below:

| | | | | | | | | | | | | | | | | |

| Executive Chairman | | Vice Chair and Lead Independent Director | | Chief Executive Officer |

| • | Establish the agenda for regular Board meetings | • | With the Executive Chairman, establish the agenda for regular Board meetings; establish the agenda for meetings of the independent directors | • | Set strategic direction for the Company |

| • | Preside over meetings of the full Board and meetings of stockholders

| • | Preside over meetings of the independent directors and serve as chair of Board meetings in absence of the Executive Chairman | • | Create and implement the Company’s vision and mission |

| • | Communicate with all directors on key issues and concerns outside of Board meetings | • | Act as a liaison between the independent directors and the Executive Chairman and Chief Executive Officer on sensitive issues; coordinate with the committee chairs regarding meeting agendas and informational requirements | • | Provide input regarding the agenda for regular Board meetings |

| • | Contribute to Board governance and Board processes | • | Preside over any portions of meetings at which the evaluation or compensation of the Chief Executive Officer or, for fiscal 2023, Executive Chairman is presented or discussed, or at which the performance of the Board of Directors is presented or discussed | • | Lead the affairs of the Company, subject to the overall direction and supervision of the Board and its committees and subject to such powers as reserved by the Board and its committees |

The Board believes that this overall structure of a separate Executive Chairman of the Board and Chief Executive Officer, combined with a Vice Chair and Lead Independent Director, results in an effective balancing of responsibilities, experience, and independent perspectives that meets the current corporate governance needs and oversight responsibilities of the Board. The Board also believes that this structure benefits the Company by enabling the Chief Executive Officer to focus on strategic matters while the Executive

Chairman of the Board focuses on Board process and governance matters. The structure also allows the Company to benefit from Mr. Cirne’s experience as a former Chief Executive Officer of the Company.

The independent directors of the Company meet at least quarterly in executive sessions. Executive sessions of the independent directors are chaired by the Vice Chair and Lead Independent Director if and when the Executive Chairman is not “independent” under applicable standards. The executive sessions include discussions and recommendations regarding guidance to be provided to the Chief Executive Officer and such other topics as the independent directors may determine.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken.undertaken, in addition to oversight of the performance of our internal audit function. The Audit Committee, through its Technology, Data and Information Security Subcommittee, also assesses the Company’s cybersecurity risk exposure and monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function.requirements. Our Nominating and Corporate Governance Committee monitors the effectiveness of our Code of Conduct and Corporate Governance Guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct.conduct, and oversees the management of the Company’s environmental, social, and governance (“ESG”) impacts and risks. Our Compensation Committee assesses and monitors whether any of our compensation programs, policies, and practices has the potential to encourage excessive risk-taking. Typically, the entire Board meets periodically with senior management responsible for the Company’s risk management, and the applicable Board committees meet periodically with the employees responsible for risk management in the committees’ respective areas of oversight. The Board as a whole and the various standing committees receive periodic reports from the head of the Company’s legal and operations groups, as well as incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

Further, our Board of Directors has been monitoring the rapidly evolving COVID-19 pandemic, its potential effects on our business, and its impact on the Company with respect to risk mitigation strategies.

Meetings of the Board of Directors

The Board met tenfourteen times during the last fiscal year. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member at the time of such meetings. In addition, as required under applicable NYSE listing standards, in the fiscal year ended March 31, 2021,2023, the Company’s non-management directors met foursix times in regularly scheduled executive sessions at which only non-management directors were present. In addition, as required under applicable NYSE listing standards, in the fiscal year ended March 31, 2021,2023, the Company’s independent directors met fivesix times in executive sessions at which only independent directors were present. Ms. Cochran, the Vice Chair and Lead Independent Director of our Board, at the time, presided over the executive sessions.

Under our Corporate Governance Guidelines, directors are expected to attend each Annual Meeting of Stockholders. SevenAll of our eight directors attended the 20202022 Annual Meeting of Stockholders.

Stockholder Communications with the Board of Directors

Our Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. This information is available on the Company’s website at http://ir.newrelic.com.ir.newrelic.com/corporate-governance. In addition, any interested person may communicate directly with the presiding director or the independent or non-management directors. Persons interested in communicating directly with the independent or non-management directors regarding their concerns or issues are referred to the procedures for such communications on the Company’s website at http://ir.newrelic.com.ir.newrelic.com/corporate-governance.

Stockholder Engagement

Over the past several years, in response to stockholder feedback, and as part of our ongoing evaluation of best practices, the Board has incorporated enhancements to our executive compensation program and corporate governance practices as described below. In fiscal 2021,2023, we actively engaged in discussions with our largest stockholders, as well as others who requested meetings with our Investor Relations team. These discussions have helped ensure that the Board’s decisions are informed by stockholder views and objectives.

As a result of the feedback we’ve received in recent fiscal years and to better align the long-term interests of the Company and our executive officers with those of our stockholders, we have:

| | | | | | | | | | | | | | |

| • | deepened our commitment to ESG initiatives by weaving them into our strategy for our technology, people, and business, and continue with the efforts to publish our annual ESG report; |

| • | appointed 3three new independent directors since the beginning of fiscal 2021;2023, including two representatives of stockholders in our Company; |

| • | decided to seek stockholder approval at this Annual Meeting of theimplemented a phased declassification of the Board, such that the Board will be fully declassified byfollowing the annual meetingelection of stockholders to be held in 2023 if Proposal No. 4 is approved;directors at the Annual Meeting; |

| • | provided investor letters that offer stockholders substantial detail regarding our business to keep them informed, including as we go through a fundamental business transformation from a subscription-based to a consumption-based business model; |

• | enhanced our disclosures in our Proxy Statement about our COVID-19 pandemic response; |

• | enhanced our disclosures in our Proxy Statement on corporate responsibility, including disclosures on our practices and commitments to community involvement, diversity and inclusion, and environmental sustainability; |

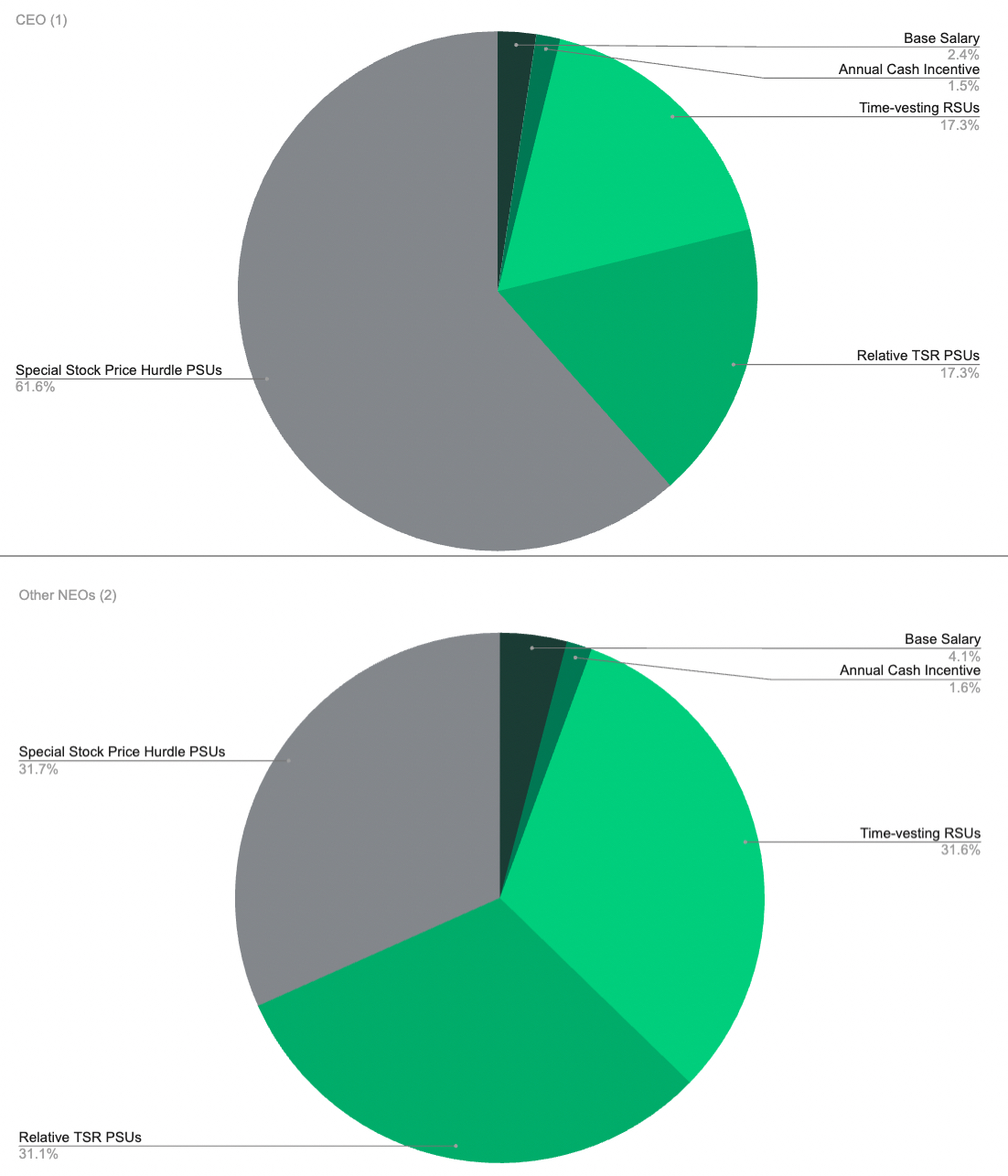

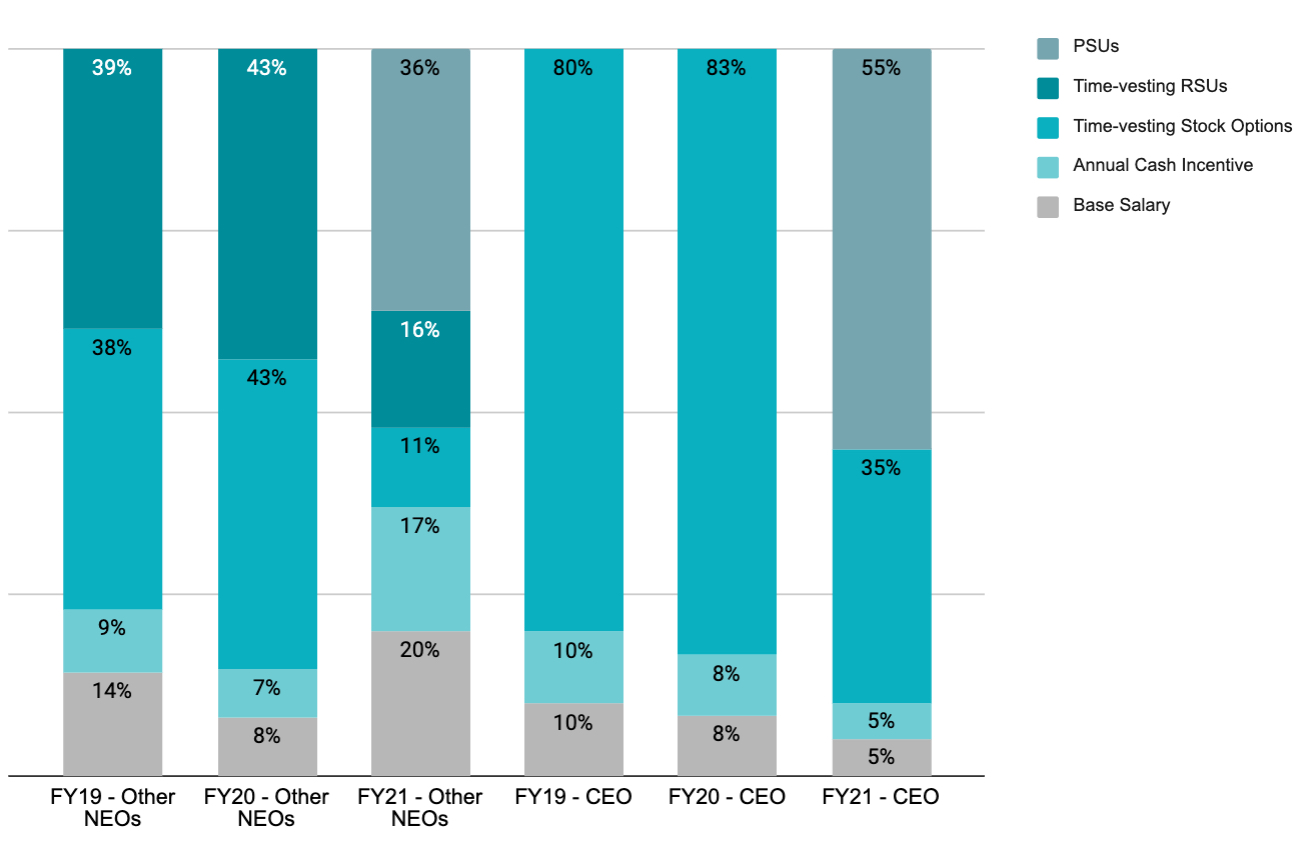

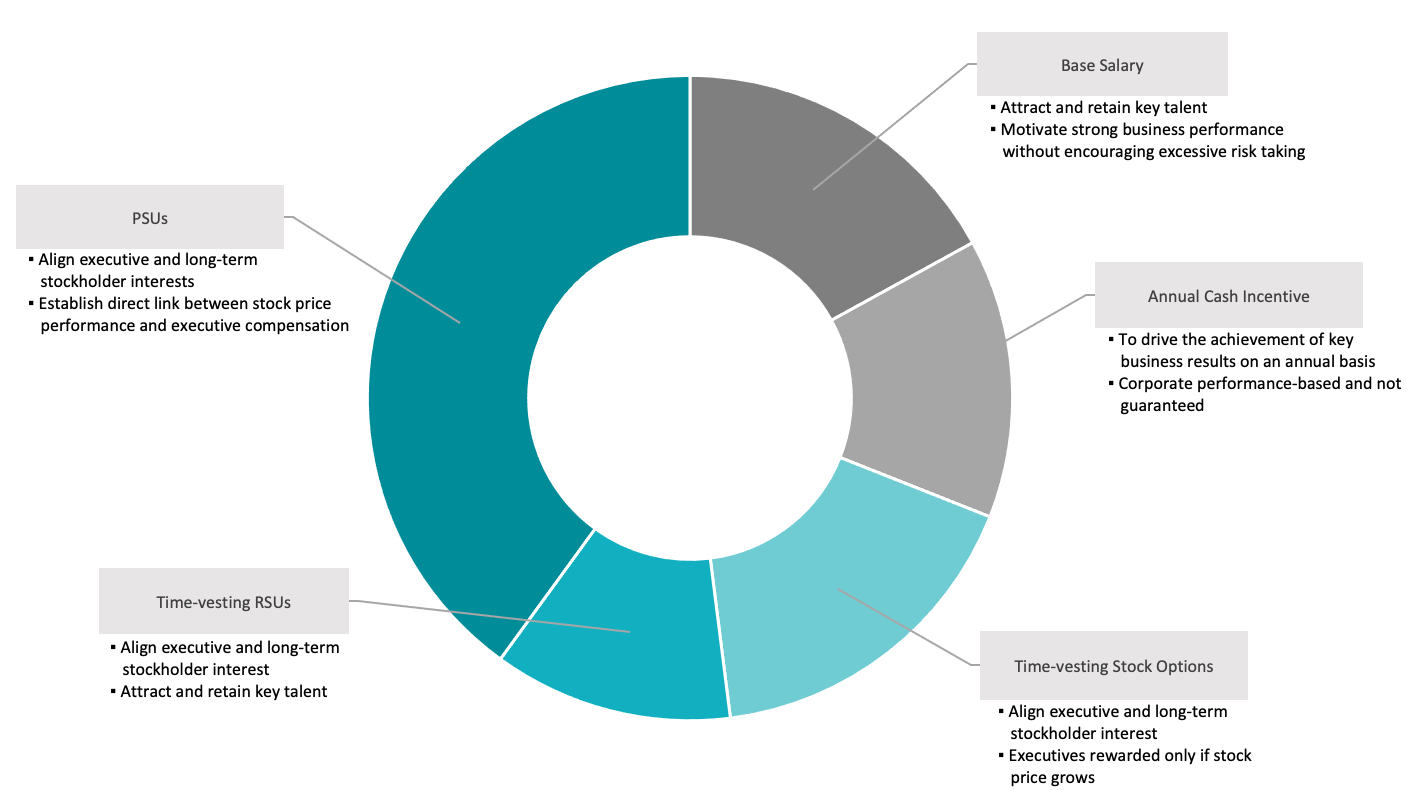

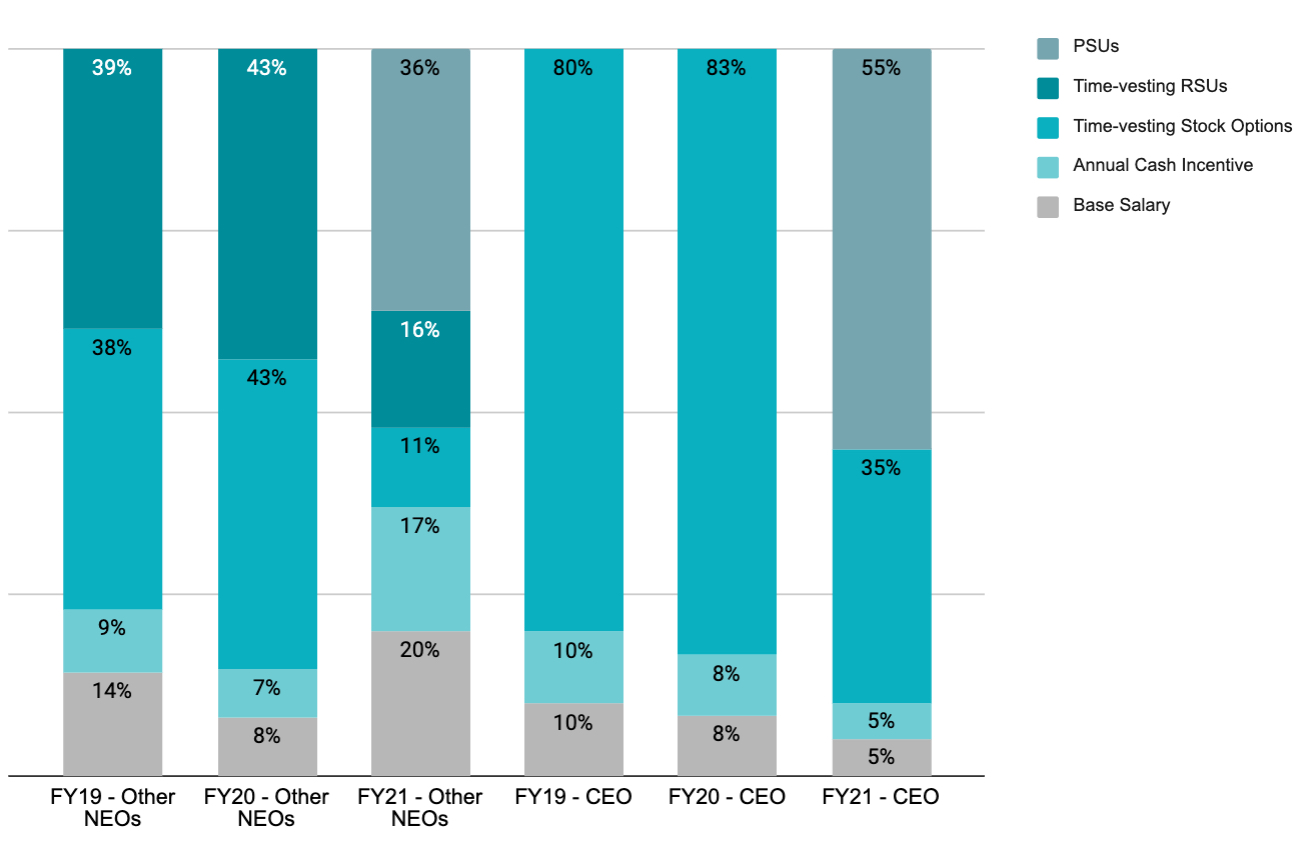

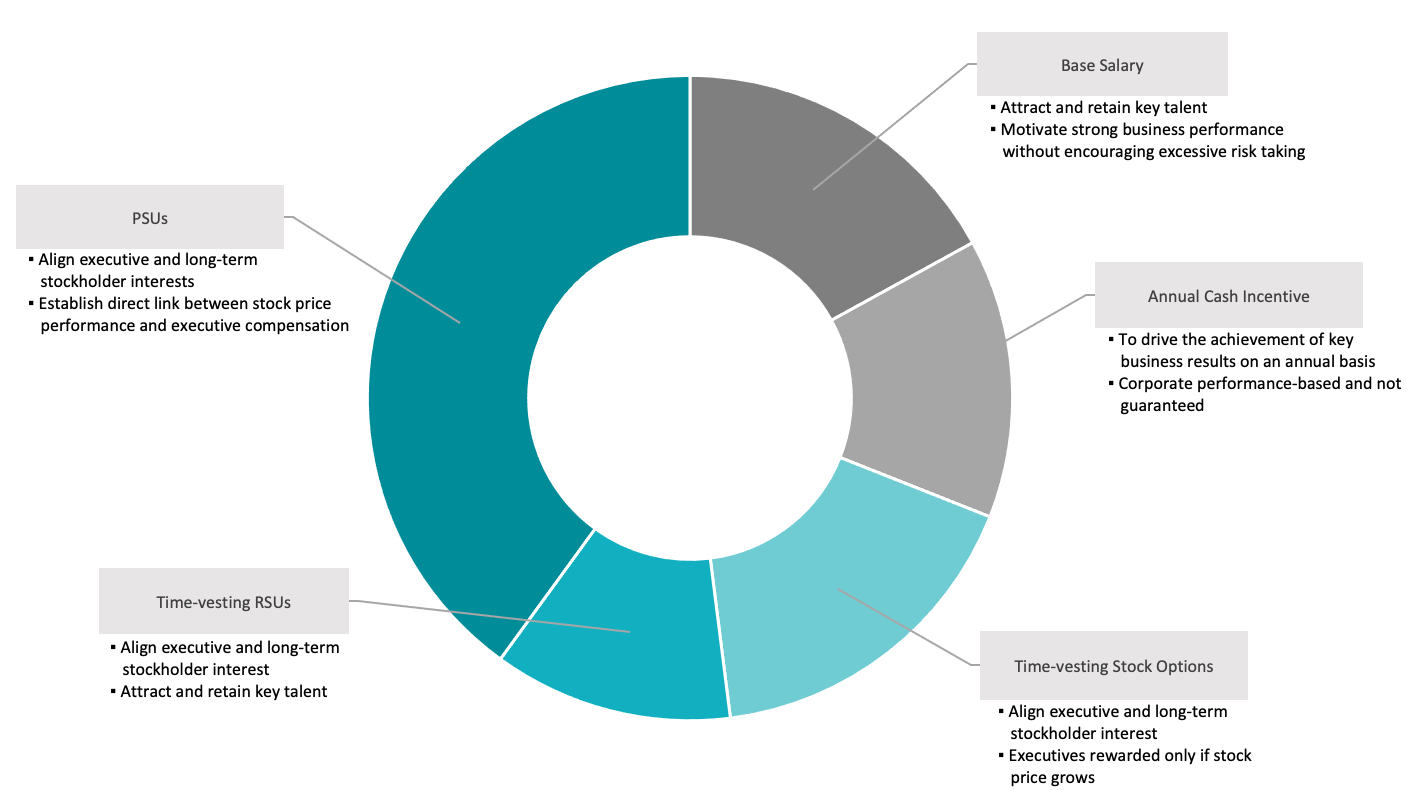

| • | approved performance-based equity awards beginningstarting in fiscal 2021, such that a meaningful portion of our executive officer compensation is now in the form of performance stock unit (“PSU”) awards, with vesting tied to our total stockholder return relative to the total stockholder return of the members of the S&P Software & Services Select Industry Index over a three-year performance period; |

| • | moved to a virtual stockholder meeting platform to provide expanded stockholder access and participation; |